We want to ensure you are getting the help you need. The benefits system supports families with living costs, and this year, the government has increased benefit rates by 10.1%, in line with inflation. This means you could be entitled to benefits that you haven’t been able to claim previously. In particular, Universal Credit, which is aimed at working-age people.

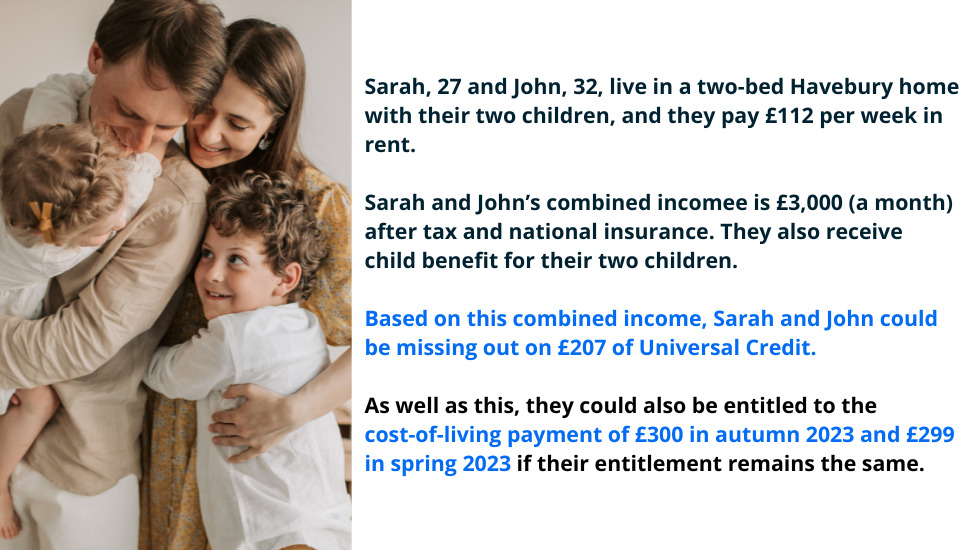

Here is an example of how someone might qualify:

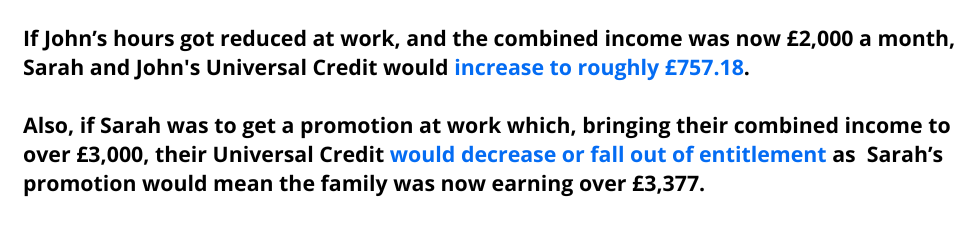

Changes to the family’s income would impact the amount of Universal Credit they would be entitled to.

It’s important to note that if you have a child with a disability benefit or are a carer for someone, you could receive extra elements in your assessment, meaning more money each month.

You can use a benefits calculator to see what you might be entitled to. They are easy to use, and you can get an answer in minutes. Click here for more information.

If you believe you are entitled to claim Universal Credit, you can find out more on how to claim here.

If you already receive some benefits (for example, jobseekers allowance, employment and support allowance, income support, housing benefit and child & working tax credit), it may not be suitable for you to claim Universal Credit right now. If you get tax credits, please seek advice before making a claim.

If you want to discuss your options, contact our Welfare and Benefits team on 0300 3300 900 extension 7305 or email myadvice@havebury.com

The post Are you getting what you are entitled to? appeared first on Havebury Housing.